Adventures in Equity

A while back I started doing some work for an old school mate of mine (Hi Tony), on a project which I can’t talk about now but has the potential to make more than that bitcoin miner that I keep forgetting to turn on.

Tony’s currently paying me at my very reasonable standard rate, but as this is a startup, I’ve also expressed an interest in purchasing a slice of this startup at some stage in the future, otherwise known as buying equity in the company.

Here’s a synopsis of what other people think are various ways of splitting equity in said startups.

I might also be able to use this post to increase the level of mystery and intrigue surrounding this project, so that once it becomes publicly-available my whatever-percentage-it-is might be valued at something greater than zero.

How to distribute equity

Let’s all agree to disagree:

According to Nithya B. Das

( http://www.forbes.com/sites/dailymuse/2012/04/05/what-every-founder-needs-to-know-about-equity/ )

- there is no formula. here are some formulas.

- idea is $0. execution is >$0

- fulltime = at least 2x parttime

- don’t pay salary (or for supply of equipment, working space etc) in equity. it’s a tax nightmare. pay for it in “convertible debt” or “series seed preferred”. mmm. series seed.

- don’t slice up equity by founder $ contribution. (also consider this payable in “convertible debt” or “series seed preferred”)

- do slice up equity by founder work contribution

- depending on what the company does, fiddle with the percentages

- think about future allocations

- equity != control. have a ‘rights of first refusal’ signed up, so you don’t end up with (insert arch-nemesis here) running the thing.

NB: “convertible debt” is a loan (with interest, payment terms etc), which transmogriphies into equity somehow

NB: “series seed preferred” is something similar, but not the same as that (see definitions below)

According to Dan Shapiro

http://www.geekwire.com/2011/wrong-answer-5050-calculating-cofounder-equity-split/

- every founder gets 100 shares, then:

- add 5% to whoever came up with the idea

- add 5-25% to whoever came up with something concrete (patent, demo, early version of product)

- add 5% to the CEO

- add 200% to anyone fulltime

- add 50-500% to anyone with superpowers (i.e. the people who were writing this list, most likely)

- x x (investor $ + effort) = ‘founder shares’, where x is determined by a lawyer

According to Joel Spolsky

http://www.brightjourney.com/q/forming-new-software-startup-allocate-ownership-fairly

- break people up into ‘layers’ (approx 1 year per layer).

- layer 1 = founders, layer 2 = first employees (i.e. getting paid a salary), layer 3 = later employees etc. later layers = less risk

- layer 1 = 50%. layer 2 = 10%, layer 3 = 10%, layer 4 = 10%, layer 5 = 10%

- everyone is vested (i.e. get 25% of allocated shares in year 1, 2% per month afterwards)

also:

- founders are fulltime

- ideas are worth $0

- investor contributions dilute everyone equally

- don’t give investors > 50%

- early founder $ contributions get paid in IOUs, not equity

According to Frank Demmler

http://thinkspace.com/how-to-divide-equity-to-startup-founders-advisors-and-employees/

- put everything (idea, business plan, domain expertise, commitment & risk, responsibilities) on arbitrary scales

- ?

- profit !

Definitions

‘convertible debt‘ explanation:

- via http://www.entrepreneur.com/article/159520

- “I need money, and you have it. But I don’t know how much my company is worth, so let’s see if professional investors or the passage of time will set the value for us while giving you an upside that’s more in keeping with the risk.”

- a lot of startups value themselves at $2.5 million for some reason

- bit of handwaving about people being happier with interest repayments when that valuation turns out to be completely wrong

- depending on your lawyer, people who give you convertible debt loans may or may not get a discount buying shares down the track

- debt “becomes” equity at some agreed event (e.g. revenue threshold, financing threshold, other milestone)

- if the agreed event doesn’t occur, you need to have some agreement as to what that means

‘convertible note‘ sounds similar to ‘convertible debt’

- via http://techcrunch.com/2012/04/07/convertible-note-seed-financings/

- ‘investors loan money to a startup as its first round of funding; and then rather than get their money back with interest, the investors receive shares of preferred stock as part of the startup’s initial preferred stock financing, based on the terms of the note.’

- convertible notes delay valuing the company until series A funding

- depending on your lawyer’s fees, ‘convertible notes’ are cheaper to create ($1-2K) than preferred stock ($10-30K)

Other things to haggle over:

- common stock vs preferred stock

- common stock has an underlying value (aka strike / exercise price) as soon as you assign to to someone for $. or does it. who knows.

- owners of preferred stock generally have other rights (e.g. board seat, veto)

- convertible notes can be priced differently for different investors

Free !

- cheap ($0) boilerplate forms: http://www.seriesseed.com/

- more of that: http://www.feld.com/archives/2010/03/the-proliferation-of-standardized-seed-financing-documents.html

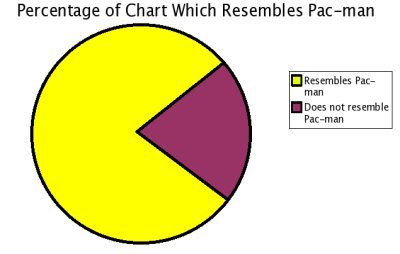

Tres Amusant!